This means that revenue is recognized when it is earned, even if the customer has not yet paid for the goods or services. Similarly, expenses are recognized when they are incurred, even if the company has not yet paid for them. Accrual accounting not only enhances the accuracy of financial reporting but also plays a significant role in financial forecasting. By recognizing revenues and expenses when they are earned or incurred, businesses can develop more precise financial projections. This method allows for a better understanding of future cash flows, helping companies plan for upcoming financial needs and opportunities. For instance, a company that accrues revenue from long-term contracts can forecast future income more accurately, enabling better budgeting and resource allocation.

Revenue Examples

This will lead to wrong calculation of earnings, which is very important for tax purposes. In addition to the purchase of these goods, the business also incurs certain other expenses that are not specifically related to these goods, such as telephone expenses. The accrual principle is often confused with—or treated as only an aspect of—the matching principle. To address the challenge of complex rules and regulations, companies need to invest in training and education for their accounting staff. This can include attending seminars and workshops, as well as providing ongoing training and support. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- This revenue is recognized as accrued revenue and is recorded as accounts receivable.

- For businesses needing to comply with GAAP or IFRS, the accrual method is often mandatory, ensuring standardized and reliable financial reporting.

- Revenue accruals occur when a company earns revenue but has not yet received payment.

- Still, it’s important to review the IRS guidelines on how to report an advance payment for services using the accrual accounting method.

- The journal entry would involve a credit to the revenue account and a debit to the accounts receivable account for accrued revenues.

Accrual Accounting vs. Cash Basis Accounting: Example

Accrued revenue is any income you expect to receive for any good or service you provided. It takes a lot of time and energy to maintain years’ worth of financial documents, checking and updating them as needed. This is why as businesses grow, they hire a part-time or full-time accountant to handle the important bookkeeping and accounting duties of the company. This may be too expensive for a small business but may be beneficial in the long term. If you plan on growing your company, it may be easier to start with the accrual method of accounting, so you don’t have to make the switch while your business is up and running. Accrued revenue is the term used when you’ve provided a good or service, but the customer has not yet paid.

Ensures compliance with accounting standards

Even though it can’t pay for it until March, the company is still incurring the expense for the entire month of January. The expected cost of internet for the month will need to be recorded as an accrued expense at the end of January. As each month of the year passes, the dental office can reduce the prepaid expense account by $12 to show it has ‘used up’ one month of its prepaid expense (asset). It can simultaneously record an expense of $12 each month to show that the expense has officially incurred through receiving the magazine. As each month of the year passes, the gym can reduce the deferred revenue account by $100 to show it’s provided one month of service. It can simultaneously record revenue of $100 each month to show that the revenue has officially been earned through providing the service.

Adjusting Journal Entries

This includes software for tracking inventory and cost of goods sold, as well as tools for calculating depreciation expenses. One of the biggest challenges with accrual accounting is that it is based on a set of rules that can be complex and difficult to understand. This can lead to errors and misinterpretations, which can impact the accuracy of financial statements. To overcome this challenge, companies need to invest in training and education to ensure that their accounting staff fully understand the rules and regulations. For businesses that don’t want to invest in expensive software or hardware, there are many subscription-based services available. These services offer cloud-based accrual accounting software that can be accessed from anywhere with an internet connection.

Accrual Principle of Accounting: Definition

If you sell $5,000 worth of machinery, under the cash method, that amount is not recorded in the books until the customer hands you the money or you receive the check. For investors, it’s important to understand the impact of both methods when making investment decisions. The cash basis method records these only when cash changes hands and can present more frequently changing views of profitability. To further elucidate the impact of accrual accounting on business operations, have a look at the practical examples and scenarios below. These real-world applications demonstrate how the accrual method is employed in different aspects of financial management, offering insights into its versatility and effectiveness. If you don’t keep a close eye on both your accrual-based books and your actual cash flow, you can end up spending money you don’t have—which can land your business in the red in no time flat.

Of course, if your business makes under $5 million a year or you’re an individual freelancer with a handful of small yearly projects, cash-basis could work for you. This means the expense has yet to be incurred and is considered an asset because X is to receive the deliverable. Here, Y will create a prepaid expense account to show the payment received for the service/product company X has to receive. The form of financial accounting that allows companies to keep up with these more complicated transactions is called accrual accounting. As a result, more companies are looking for highly skilled financial accounting professionals, well-versed in this method.

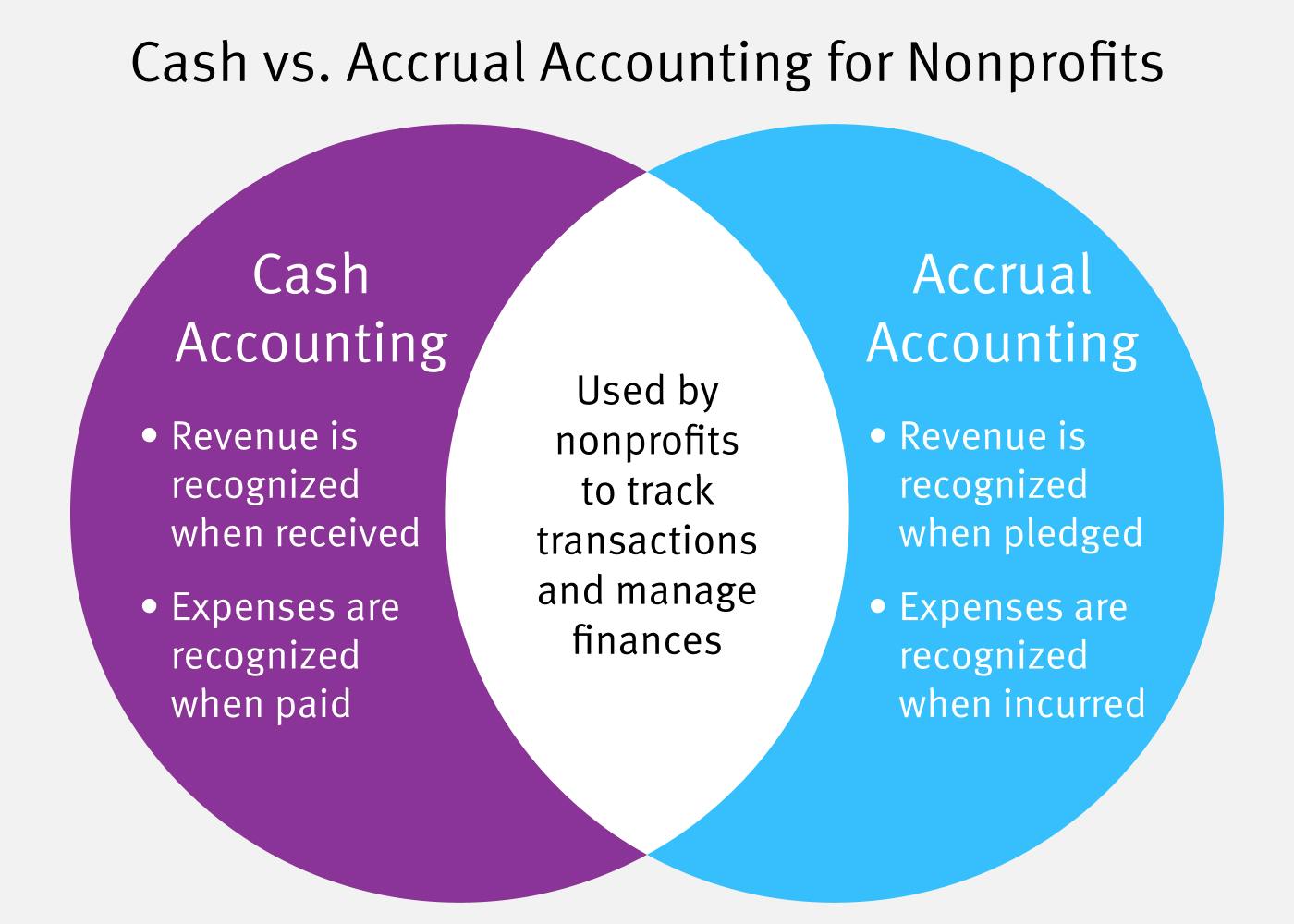

Cash basis accounting records revenue and expenses when actual payments are received or disbursed. On the other hand, accrual accounting records revenue and expenses when those transactions occur and before any money is received or paid out. Accrual accounting is a financial accounting method in which a company records its revenue and expenses as they are earned or incurred, regardless of whether it receives or makes the payment. petty cash book: types diagrams and examples This differs from cash accounting, which records revenue or expenses only after receiving/paying the money in exchange for goods/services. Accrual accounting is an accounting method where revenue or expenses are recorded at the time in which they are earned or incurred, irrespective of when the actual cash transactions occur. It utilizes two core accounting principles, the matching principle and the revenue recognition principle.

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills.