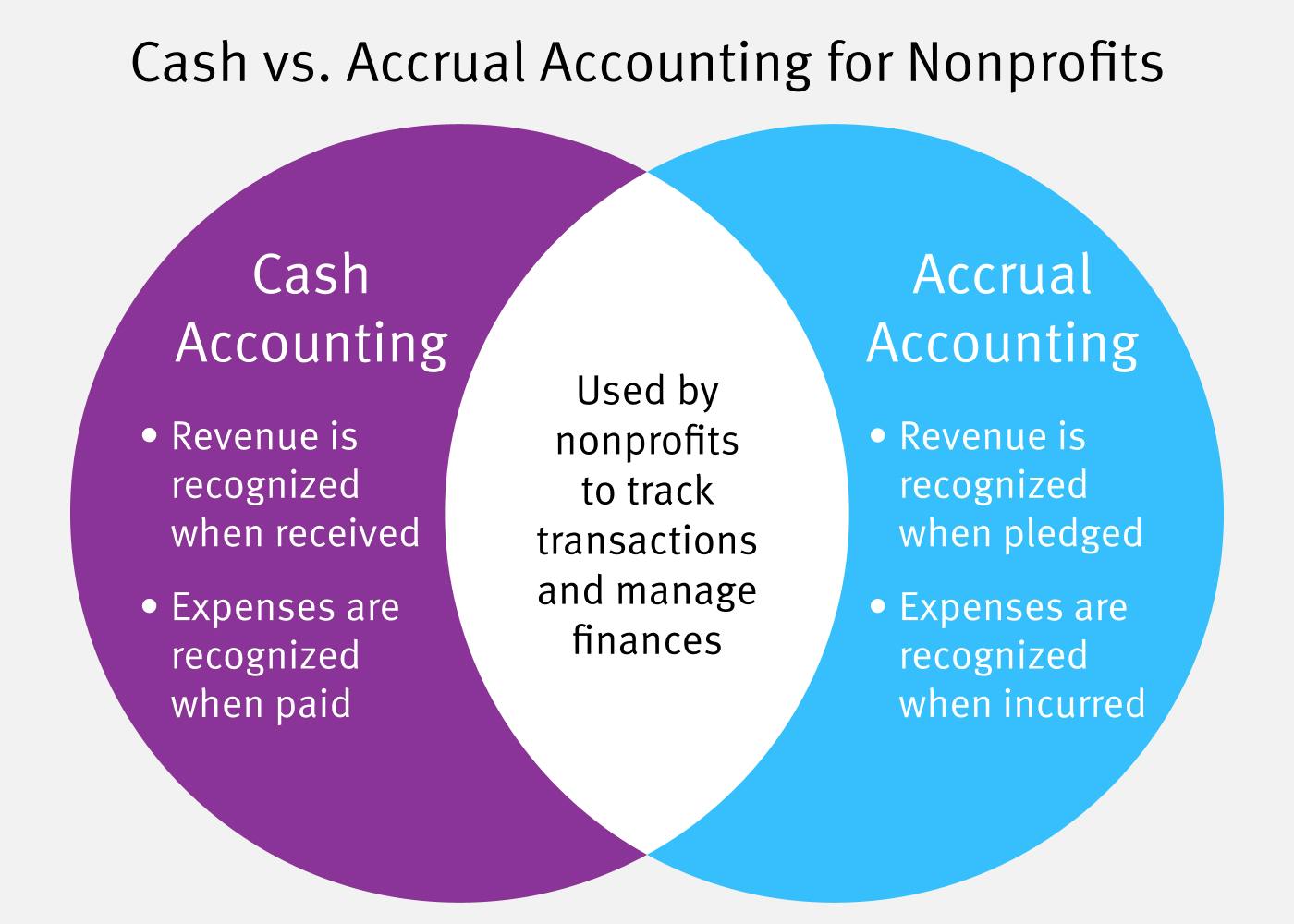

For example, under the cash basis method, retailers would look extremely profitable in Q4 as consumers buy for the holiday season. However, they would look unprofitable in the next year’s Q1 as consumer spending declines following the holiday rush. A company might look profitable in the long term but actually have a challenging, major cash shortage in the short term. For example, a company might have sales in the current quarter that wouldn’t be recorded under the cash method. An investor might think the company is unprofitable when, in reality, the company is doing well.

Why do I need to follow the accrual principle?

Accrued assets and liabilities are those that have been earned or incurred but have not yet been recorded in the accounting system. For example, a company may have earned interest on an investment, but the interest has not yet been received. Similarly, a company may have incurred interest expense on a loan, but the payment has not yet been made.

Depreciation Expenses

- Prepaid expenses are assets that represent payments made in advance for goods or services that will be received in the future.

- For example, if you provided a consulting service for $100 in January but you expect the customer to pay in February, you’ll have an accrued revenue of $100 in January.

- For public companies and for any other organizations that prefer GAAP (generally accepted accounting principles) compliance, they have to follow the accrual accounting method.

- The specific journal entries will depend on the individual circumstances of each transaction.

- Under the accrual basis of accounting my business will report the $10,000 of revenues I earned on the December income statement and will report accounts receivable of $10,000 on the December 31 balance sheet.

That isn’t to say it’s beyond the grasp of most small-business owners—just that there’s a learning curve, and it can feel a little steep for the non-accountants among us. Big businesses widely use it to comply with standard accounting terms and principles like Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This happens when you receive a good or service, but the provider expects you to pay at a later date. For example, let’s say you received merchandise for your business in March and received an invoice of $500 with payment due in April. This is common when customers pay for a subscription or have recurring payments, like a phone bill.

Impact on Financial Statements

There are also many software companies that specialize in accrual accounting software. These companies offer more advanced features and customization options than standard accounting software, but may come at a higher cost. Generally Accepted Accounting Principles (GAAP) are a set of accounting standards that are used to ensure consistency and accuracy in financial reporting. GAAP accountants tauranga standards are used by companies in the United States, while International Financial Reporting Standards (IFRS) are used in other countries. The matching principle requires that expenses be matched to the revenue they help generate. This means that if a company incurs an expense in order to generate revenue, the expense must be recognized in the same period as the revenue.

Users can submit receipts through Text, Gmail, Outlook, Slack, or directly on the Fyle mobile and web apps. Fyle extracts, codes, and tracks expense data in one place, eliminating the need for spreadsheets and reducing time spent on receipt management. Software can automate complex calculations, such as prorating long-term obligations over multiple periods, which significantly reduces the risk of human error. You will compute indirect expenses by applying the ratio of indirect over direct labor hours.

This would involve debiting the “expenses” account on the income statement and crediting the “accounts payable” account. The offset to an accrued expense is an accrued liability account in double-entry bookkeeping. The offset to accrued revenue is an accrued asset account and this also appears on the balance sheet. An adjusting journal entry for an accrual will therefore impact both the balance sheet and the income statement. Accruals are revenues earned or expenses incurred that impact a company’s net income on the income statement but cash related to the transaction hasn’t yet changed hands. Accruals also affect the balance sheet because they involve non-cash assets and liabilities.

Adherence to accrual-basis accounting is often a regulatory necessity for these businesses to align with GAAP and IFRS standards. In the revenue recognition principle, organizations recognize revenue when it’s actually earned or at the time of delivering products/services to customers. Accrued expenses, also known as accrued liabilities, occur when a company incurs an expense it hasn’t yet been billed for. Essentially, the company received a good or service that it will pay for in the future. Accrual-based accounting is a popular method for big companies, as it uses the double-entry accounting method, which is more accurate and conforms with the generally accepted accounting principles (GAAP). Accrual basis accounting recognizes revenue when the service is provided for the customer even though cash isn’t yet in the bank yet.

This means that a company may have accrued expenses and revenue but not recorded them yet in their financial statements if they expect to receive payment or make payments at some point in the future. Here, the expense accruals are recorded as incurred in the financial statements since the company has received the product/service, even if the payment is due. At the same time, the expense is considered a liability because the company is obligated to pay for it in the future. Even more complicated are transactions that require paying for goods or services or receiving money from customers in advance.

The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site.

The principles of accrual accounting are the frameworks that guide how a company should record its financial transactions, i.e., revenues and expenses. Accrual accounting is the preferred method according to generally accepted accounting principles (GAAP). It’s widely considered to provide a more accurate and comprehensive view of a company’s financial position and performance than the cash basis of accounting which only records transactions when cash is exchanged.